State Farm’s premiums are the most cost effective out of all the businesses on our list, each for prime- and low-threat Florida drivers. Although Farmers presents perks like rental reimbursement, it prices some of the highest premiums out of all the companies on our record, both for prime- and low-risk drivers. Out of all of the insurers on this listing, Progressive expenses a few of the lowest rates in Florida. Uninsured drivers in Florida may have their driver’s license and registration suspended and be required to pay a reinstatement payment of as much as $500. Discounts: Safe driving, military and federal worker reductions, loyalty, safety equipment and driver’s schooling. As per Florida’s DMV, failure to keep up the required automotive insurance coverage coverage even during the registration interval might culminate in your driver’s license and license plate being suspended for up to a few years. While lower-risk drivers may benefit from Liberty Mutual’s competitive premiums, this isn’t the case for larger-threat drivers.

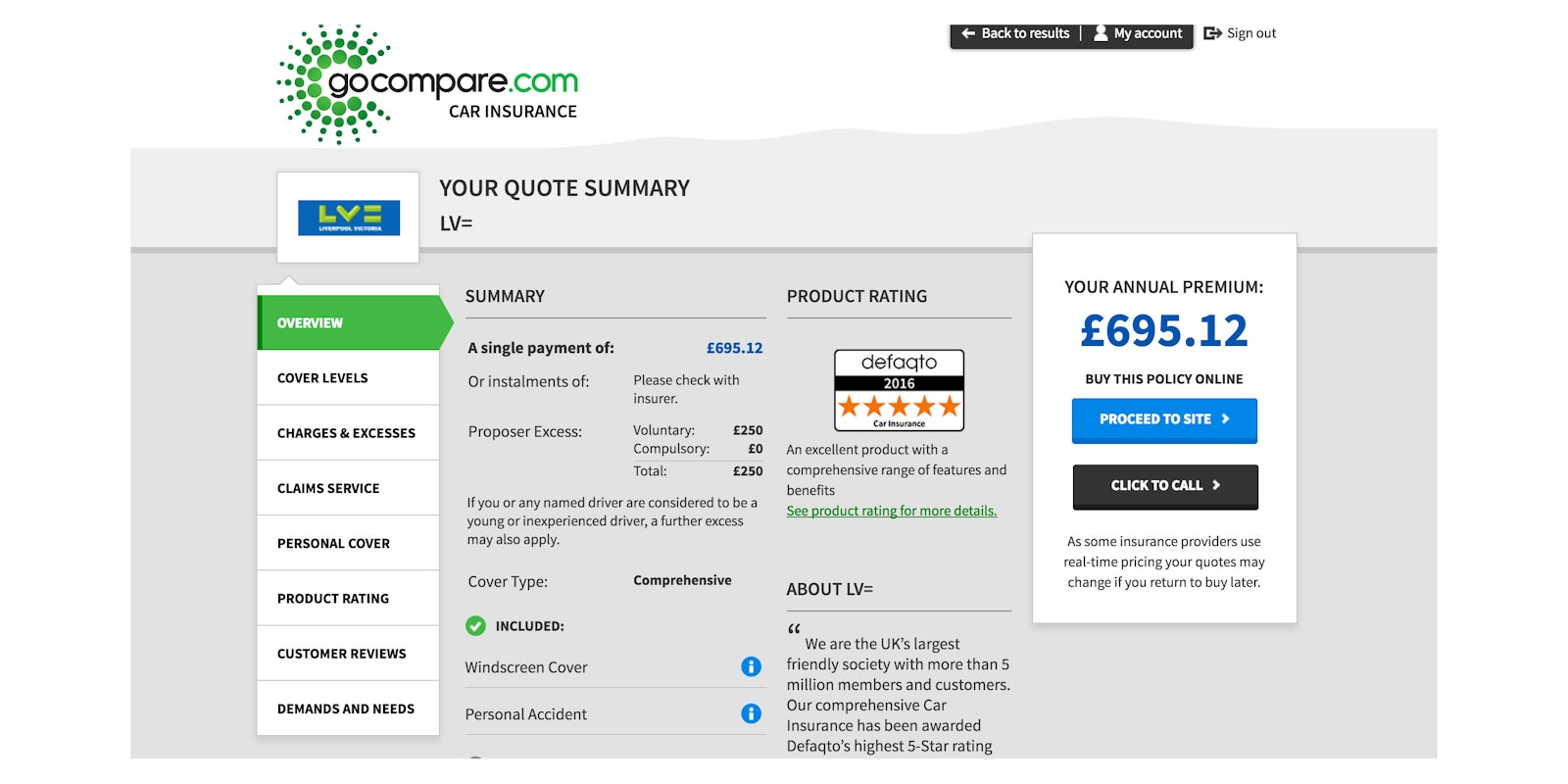

Whereas it’s true the company gives few extra protection options for the value, its Name Your Price Instrument is amongst its most attractive features, allowing Progressive customers to purchase automotive insurance based mostly on what they can afford and their state’s minimum legal responsibility protection necessities. Tools: Auto insurance tips & assets weblog, a restore facility locator instrument and Easy Insights articles on insurance coverage, savings and more. Tools: Geico Driving and Safety Ideas Weblog, an area gas costs comparison device, automotive shopping for resources, a parking locator app and a coverage calculator. Comparison procuring is top-of-the-line ways to make sure you’re not paying greater than you have to for the automobile insurance protection you want. For those who store round, you may find that you’ll save extra in case you have policies with separate insurers. By paying a higher deductible, you are taking on more monetary responsibility for a claim. DriveEasy App: Get a premium low cost for secure driving. Drivewise App: Get a discount on your automobile insurance fee for save driving. For example, you’re entitled to a “safe driving bonus” test for each six months you are accident-free and can qualify for accident forgiveness even if you’re a high-threat driver. That means some firms embrace further coverage options you cannot opt-out of, like PIP, rental reimbursement or accident forgiveness.

Whereas it’s true the company gives few extra protection options for the value, its Name Your Price Instrument is amongst its most attractive features, allowing Progressive customers to purchase automotive insurance based mostly on what they can afford and their state’s minimum legal responsibility protection necessities. Tools: Auto insurance tips & assets weblog, a restore facility locator instrument and Easy Insights articles on insurance coverage, savings and more. Tools: Geico Driving and Safety Ideas Weblog, an area gas costs comparison device, automotive shopping for resources, a parking locator app and a coverage calculator. Comparison procuring is top-of-the-line ways to make sure you’re not paying greater than you have to for the automobile insurance protection you want. For those who store round, you may find that you’ll save extra in case you have policies with separate insurers. By paying a higher deductible, you are taking on more monetary responsibility for a claim. DriveEasy App: Get a premium low cost for secure driving. Drivewise App: Get a discount on your automobile insurance fee for save driving. For example, you’re entitled to a “safe driving bonus” test for each six months you are accident-free and can qualify for accident forgiveness even if you’re a high-threat driver. That means some firms embrace further coverage options you cannot opt-out of, like PIP, rental reimbursement or accident forgiveness.

Accident Forgiveness: Accident forgiveness is offered at a further cost. Meaning state legislation requires all drivers to file bodily harm or medical fee claims through their very own insurer, no matter who is at fault in an accident. The car insurance quotes collected for Money’s Finest Car Insurers in Florida are for protection quantities that exceed the state’s minimal legal responsibility insurance coverage necessities of $10,000 in personal damage safety (PIP) and property harm legal responsibility (PDL) coverage. Quotes obtained for the purpose of this analysis exceed the minimal legal responsibility insurance coverage requirements in Florida. What’s the minimal legal responsibility insurance requirement in Florida? Low-risk drivers in the state of Florida can anticipate to pay between $1,001 for minimum coverage and $1,657 for max coverage with Farmers. Low-risk Progressive prospects in the state of Florida can anticipate to pay between $395 for minimum protection and $903 for maximum coverage. Federal Employees Program: Eligible shoppers can receive unique reductions or scholarships. In distinction, excessive-threat Geico clients might anticipate to pay as much as $5,311. As for premiums, low-risk customers can expect to pay roughly $849 for automotive insurance with Geico. At first glance, this could be a easy answer to simplify your monthly payments. Collision protection may also protect you from certain events, similar to a collision with a stationary object because of strong winds or rain.

Traditional & Collector Automotive Insurance: You possibly can add roadside assistance, up to $750 in spare components protection, and full windshield and safety glass coverage to your coverage. Your automotive insurance coverage coverage might cowl hurricane-related injury, depending on the coverages you have bought and the damage your automobile sustains. Reductions: Online buy, bundling policies, early customers, student discounts, army, security features, alternative energy, protected driving and paperless coverage reductions. However, bundling insurance might not at all times be the most cost effective choice in certain cases. Bundling insurance coverage is a simple approach to cut down the price of your premiums. According to the Insurance Info Institute, if your older automobile is price less than 10 times the premium you’re paying for it, these two coverages will not be price the price. Savings opportunities for which chances are you’ll qualify. In some instances, navy members stationed out of state could also be exempt from sustaining steady car insurance even when they are Florida residents. Allstate is the highest automobile insurance coverage provider for the state of Florida for overall buyer satisfaction based mostly on J.D. State Farm is featured in J.D. Liberty Mutual acquired an above-average customer satisfaction rating in J.D. Farmers wasn’t included in J.D.

While Amica Mutual isn’t featured in J.D. While danger elements fluctuate from one insurer to the subsequent, some key factors are frequent amongst insurers. Many insurers use credit data to find out car insurance premiums. Statistical information linked to larger or lower risks of incurring losses. Milewise App: Get a lower premium based mostly on how a lot and the way effectively you drive. Snapshot Program: Personalizes your auto insurance charge based mostly on how you drive. Decrease-danger drivers pay a mean price of $1,485 for minimal coverage and $2,359 for full protection with Allstate. It additionally affords some appealing coverage choices for many who gather antique or vintage cars. You possibly can, nevertheless, alter protection limits based in your wants. Comprehensive coverage, for example, will cover perils comparable to hurricane and flood harm in addition to harm caused by falling objects. Signal App: Save as much as 15% on premiums for good driving behavior. If or when you are in the market for a new automobile, consider the worth of getting a mannequin with good safety options. By contrast, higher-danger drivers may pay between $1,756 and $3,977.